The 2020s Depression

This might be one of my most negative pieces. So I shall keep it short! We are facing the biggest crisis I have ever seen in my career observing economies and societies. The fate of human civilisation might be determined by how we respond to it.

“You must understand change: if you only know what is regular, what is unchangeable, and do not know change, you will be like the man who dropped his sword in the water and tried to find it again by making a mark on the side of his boat – wasting his time.”

Liu Yin, Ming Dynasty Scholar (from a book China’s Change)

Last week I spoke at the annual Bank of America Merrill Lynch conference in Tokyo. My own talk was about slightly longer term issues through to 2030. And on that time frame I am quite optimistic. I suggested that by 2030 we would have a new financial architecture and we should also consider which city will be the financial capital of the world then? Will it still be New York and London – or will Shanghai and Hong Kong have toppled them. Perhaps there won’t be a capital because we’ve transitioned to a decentralised system. But before then, in fact within the next 18 months, it seems likely that we will enter the next full blown economic crisis.

It always takes time for investors to wake up to the risks around them. And its always tempting to try and pick up nickels in front of a steam roller! I still remember 2007 very clearly when the risks were becoming quite evident. Already the US was in a full blown housing recession and various parts of the financial system were blowing up. In fact I remember speaking to a bond trader in the summer of 2007 who said in his 30 year career he’d never seen anything like the conditions he was trying to navigate. And yet it took until the end of 2008 for real panic to set in.

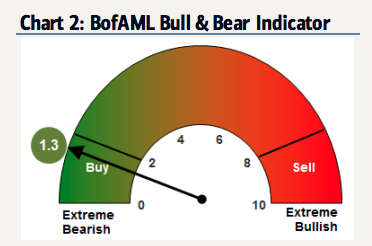

This is why I have sympathy for the view that risk assets can easily bounce again before crisis kicks off. Bank of America Merrill Lynch strategist, Michael Hartnett, did a talk after mine in Tokyo. Short term he is positive basically because everyone else went negative. Their Bull & Bear indicator (the bank’s flagship positioning signal) flashed a contrarian buy signal recently after diving to 1.3 from 2.4. It’s the first buy signal since January 3. For those not in finance this back to front way of thinking is basically when a lot of investors are already negative it means that it only takes a little good news for investors to jump back in to markets. The opposite is also true, when everyone is universally positive, it means that stocks might find it difficult to find additional buyers.

2020s Crisis

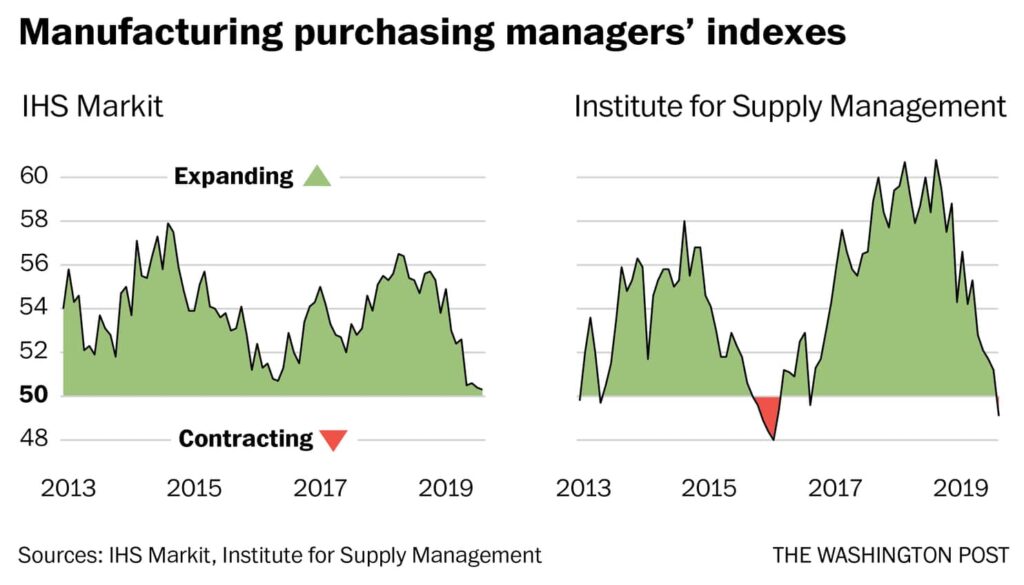

But the bigger dynamics are pretty bad. Already economists are acknowledging we are in a manufacturing recession. The warning signs have been out there for some time. But now its clear in the USA as well.

But many economists compartmentalise the economy and think that because the US consumer is robust, we will all be fine.

The Only Game in Town

I have been pointing at weakness across the global economy for some time. South Korea just printed a 0% (CPI, the lowest since the 1960s when records began, reflecting the very poor macro environment. Germany might already be in recession after printing one negative quarter of GDP. But the US consumer seems to be holding out , at least this is what we are told.

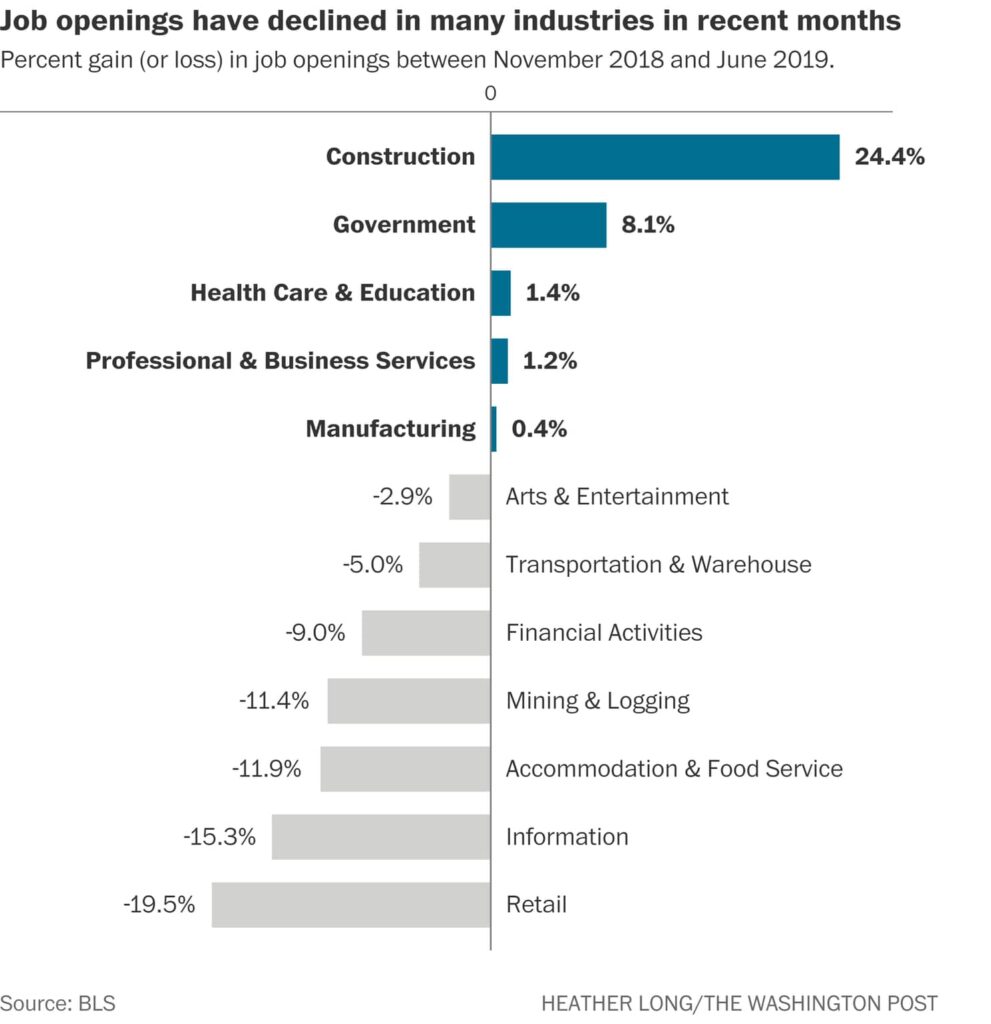

However, as companies operating environment is so poor, companies will gradually curtail both Capex and hiring in all liklihood. This year we have seen job gains of 143,000 per month, a significant slow down from last year’s average of 192,000 according to the ECRI.

Already some industries are starting to crack:

I always find it amazing when people – including economists – compartmentalise parts of the economy. As an amateur ecologist I think this is madness. Eventually things spill over.

There are a number of global catalysts for a bigger global recession

a. The US-China Technology Cold War

Some economists and futurists like myself, believed that China had already reached its zenith in terms of being the factory of the world for 2 key reasons. First, as a result of risk diversification, corporates would begin to move assets to from China. This has already been happening for many years now. Second, technologies such as more advanced AI and automation as well as 3D printing would mean that manufacturing might come back to the industrialised world. However, the Trump administration is endeavouring to accelerate this and destroy global supply chains very quickly. And it is the only issue where he has support across Congress – in fact there are even members of the Senate and Congress who are more hawkish than him. This rapid shock to global supply chains will cost companies money and the general sentiment is souring as they worry about the end of globalisation. Furthermore, domestic prices will have upward pressure now with the trade tariffs.

Don’t get me wrong, there is a chance of some kind of trade deal. But it could well be superficial. This is much deeper than that. The Americans have finally woken up to the fact that China is way more advanced in technology than they thought. And now China has realised how much the US has pivoted, British (ARM) and American technology was a real shock. So whatever happens they will be working harder than ever on indigenous technology. And on the US side, this whole saga will mean than MNCs will seriously reconsider supply chains. If a trade deal is announced, then clearly markets might bounce but don’t be fooled.

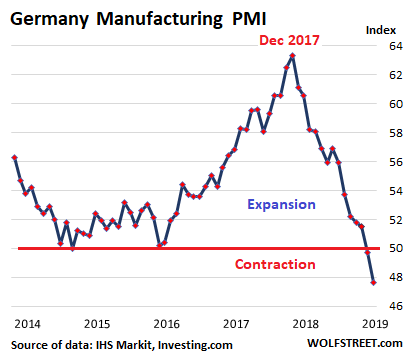

b.Crisis in Europe

Already Germany is suffering from the manufacturing and technology recession. But as things worsen across the Eurozone its quite likely that we will see a full on banking crisis. In fact, when I was in the City of London recently one of the top investors there shared his fears that the Eurozone was already on the precipice of a bank run. Part of this has to do with the implementation of the BRRD which removed guarantees for large deposits. The well known financial historian and strategist Russell Napier has been writing about this as well. Depositors need to think like investors now and as word circulates how fragile the system is, more depositors will move money out of banks and possibly into government bonds where at least there is some interest. Think about it, if one buys a government bond there is a risk of a nominal fall in value, however they don’t face the possibility of being bailed-in during a bank run and then having one’s money frozen and possible dragged through courts.

The banking sector in Europe is already in a deflationary spiral. Lower negative nominal bond yields are causing a contraction in bank balance sheets which then results in a contraction in broad money growth and quite possibly the failure of some major financial institution or bank.

Brexit might also accelerate this. At the moment the media, and investors, have focused on the risks to the UK economy. Short term, I concur and continue to be negative on the British pound. But finally we are seeing some press out about the negative impact on the German manufacturing sector as the UK is a significant buyer of German exports. In fact, the contrarian view here could be that the UK will later be seen to have avoided a worse crisis by being in the EU as a banking crisis kicks off. When the UK was going to pull out of the Euro, the pundits said it would be a disaster, but sticking with the pound turned out to be a good thing. Obviously it’s not in the EU’s best interest to allow a successful Brexit as others will follow. Anyway, I won’t dwell on this as there is so much to say regarding Brexit.

Longer term, I see much potential in Europe and this is why I am involved in one of Europe’s newest and interesting think tanks, Futur.io. I wrote a chapter in their book about what we can learn from Asia. One o the opportunities is to seize upon is indeed Asia – cementing the Eurasian ties of the ancient Silk Roads. But much has to be done first.

C. Geopolitical flair up

There is always potential for a limited conflict with China in the South China Sea. Steve Bannon has even suggested that the US give China 72 hours to remove all the military equipment they have on their articifical islands and forcibly remove them on the 73rd hour. I am not for a moment saying this is likely but there is a chance of conflict. Some might say this has abated with the hawkish Bolton leaving the Whitehouse but I am not entirely sure.

The other conflict which some people now think even more likely is over Iran. The latter would immediately cause a spike in oil prices.

d. Extreme Weather

During the 2020s there might also be further surprise weather events, including some global warming and cooling, which could be a disaster for food prices. We have had pretty extreme winters and summers in recent years. I’m actually more fearful of the risks of a mini ice age as this could cause agricultural prices to spike. Also who knows what ramifications there will be if we continue to destroy entire eco-systems with the Sixth Extinction.

The economist Nouriel Roubini thinks that many of the risks facing the global economy today are supply side shocks. In fact the entire list above -apart from Europe – is supply side. This means that a different response might be required:

“There is an important difference between the 2008 global financial crisis and the negative supply shocks that could hit the global economy today. Because the former was mostly a large negative aggregate demand shock that depressed growth and inflation, it was appropriately met with monetary and fiscal stimulus. But this time, the world would be confronting sustained negative supply shocks that would require a very different kind of policy response over the medium term. Trying to undo the damage through never-ending monetary and fiscal stimulus will not be a sensible option.”

Every financial crisis is a bit different. If you expect things to play out exactly the same as 2008/9 you’ll not be prepared. So whilst there might be some deflationary shocks, overall Im currently wondering about a stagflationary depression. This means negative to low growth and high inflation.

This next economic crisis might well throw oil on the flames of many of the problems we already have – particularly the divides we have in Western society. Western Civilisation could go into full decline with China emerging as a new superpower by the end of this. But if wise leaders and statesmen and women appear, it possible that Western societies and economies make a necessary transformation and allow the peaceful emergence of China, as well as a transition to a more global ecological and human civilisation.

The human species has gone through many crises in the past. And in every crisis there is opportunity – whether that’s investment opportunities , career opportunities or opportunities to stand up and be a change maker. Remember some of the best companies are formed in downturns and great leaders always emerge in crisis. It is certainly not time to be paralysed by fear and confusion. I hope to be of service to my clients and in my blogs in making positive suggestions for dealing with all this uncertainty.